Supply Chain Disruptions Impacting the Wire & Cable Industry

- Kassie Teagarden

- Company News

- Jul 29, 2022

- 8698views

Global Supply Chain Disruptions Impacting the Wire and Cable Industry

Written By: LAPP Tannehill

As global supply chain disruptions continue through 2022, LAPP Tannehill explores the economic forces that impact supply chain management and how it affects the wire and cable industry.

It is becoming increasingly difficult to understand what’s happening in the global economy and plan for the resultant impact to our personal and professional lives due the seemingly endless stream of concerning news from around the globe.

From the ongoing impact of the post-pandemic consumption shock, to lockdowns in China (the world’s largest manufacturing economy), rampant shortages of everything from critical electronics components to the stuff of our everyday lives, the ongoing conflict in Ukraine, fears of upcoming global recession (and even stagflation) as the Fed and other Central Banks hike up short term interest rates to combat historical inflation levels and last but not least the almost unprecedented spikes (and most recently crashes) in commodity prices in response to all of these market dynamics.

All of us at LAPP Tannehill are in one way or another grappling with the shifting forces of the global macro-economy and their impact to the wire, cable and electrical connectivity industry. Since our last update in November 2021 much has happened in our industry.

Economic, Geopolitical, and Societal Forces Impacting Supply Chain Management

Post-Pandemic Demand Shock

While the world is thankfully recovering from the effects of the global pandemic, according to a McKinsey report “The Consumer Demand Recovery and Lasting Effects of COVID-19” one of the side effects has been a record level of consumption spikes from consumers across the globe.

This has been fueled by both pent-up demand and an accumulation of savings (for example US and UK consumer savings levels are over 2x that of pre-pandemic levels).

With consumer spending comprising approximately 70% of global GDP (Gross Domestic Product) this unprecedented demand shock has caused strains on global supply chains in every industry.

China Lockdowns & War in Ukraine

Pressing international situations in China and Ukraine are further exacerbating the global supply chain situation.

China, which is responsible for over 10% of global trade, and their COVID restrictions have idled factories and warehouses, slowed deliveries of countless manufactured goods, and exacerbated container logjams - particularly in the U.S. and Europe where critical ports are already backed up. (“Global Supply Chain Crisis Flares Up Again Where It All Began”.)

“Once product export activities resume and a large volume of vessels make their way to the U.S. West Coast ports, we expect waiting times to increase significantly,” said Julie Gerdeman, CEO of supply-chain risk analytics firm Everstream Analytics.

The war in Ukraine "has not only created a humanitarian crisis but led to extensive economic impacts. Ukraine’s economy is in disarray as the supply chains providing food, textiles, and other goods, along with the equipment and materials that support the country’s industrial and agricultural sectors, are either stressed or broken.” (IPS, International Politics and Society, journal in “How the War in Ukraine Impacts Global Supply Chains”)

Key commodities such as neon, palladium, lithium, cobalt, nickel and more are sourced from either Ukraine or Russia which “highlights the complex, global, and interconnected nature of contemporary supply chains. As the chip and automotive supply chain show, a disruption in one part of the World can significantly impact operations globally. There are no easy answers to adapt to these disruptions either.”

Where is the Global Supply Chain Headed?

With all of the aforementioned (and many other) forces negatively impacting the global supply chain the obvious question to ask is, where is this headed?

A good measure of the overall global supply chain situation is the New York Fed and its Global Supply Chain Pressure Index (GSCPI).

The GSCPI tracks a combination of global transportation costs as well as purchasing manager index (PMI) surveys on delivery times, backlogs and purchased stocks at key global manufacturing terms.

The GSCPI started to decline between December 2021 and March 2022 (see below) indicating an easing of supply chain pressures as the global economy continued recovering and adjusting to the pandemic landscape.

April Data Indicate Worsening of Supply Chain Pressures

Chart shows a 25 year history of global supply chain pressures finally easing up after dramatic spikes seen in the last few years.. only to see renewed strains emerge as of April 2022.

But in April 2022 the reading started to worsen (suggesting negative impact from the new strains in global supply chains) and is still holding at historically high levels.

In summary, the GSPCI is currently about 3 standard deviations above historical averages, which is lower than its highest point of +4.5 earlier this year (good news), but has recently up ticked in April (bad news) and is still at very elevated historical levels (bad news).

To gauge the situation moving forward it will be interesting to see if the GSPCI can go below the +3 level and stay there or even go lower towards historical normal levels. You can view the latest GSPCI (updated monthly) here.

What’s Happening in the Wire and Cable Industry?

Now that we’ve looked at the current state of the general global supply chain situation lets focus on Wire and Cable.

The Current State of Supply Chain Shortages in Wire and Cable

Within the Wire and Cable industry LAPP Tannehill is starting to see modest improvements in product lead times across our 200+ manufacturer base but they are still not near pre-pandemic levels.

According to Brian Arickx, Director of Supply Chain at LAPP Tannehill, “Volume spiked early during the pandemic and has remained steadily high, but we are managing it more efficiently and proactively. Lead times are not yet at pre-pandemic levels, but we are seeing improvements as 2022 continues.”

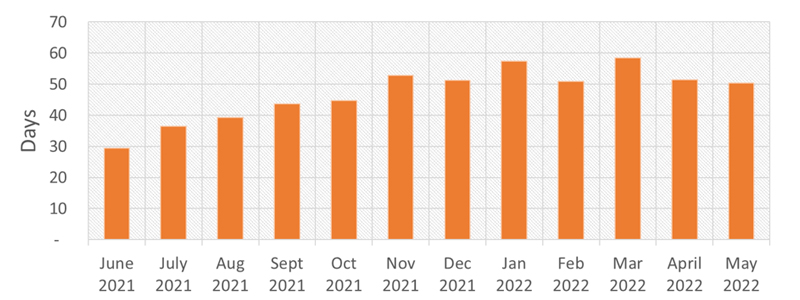

The chart below shows our average manufacturer lead times for the past 12 months.

Average Manufacturing Lead Times

Chart indicates lead times slowly decreasing since January of 2022.

Per Brian, “In January 2022, LAPP Tannehill’s lead time averages peaked around 50 days. We have since recovered to about 40 days at the end of June.”

While average lead times seem to be finally turning the corner the industry is still under tremendous pressure and pockets of very high lead time items are still common. The chart below shows the standard deviation of lead times for the past 12 months.

Standard Deviation of Manufacturing Lead Times

Chart shows standard deviations of manufacturing lead times from June 2021 to May 2022.

Although there has been a decline in lead times recently, they are not easing up anytime soon.

According to Brian, “Since January 2022, we have started see some lead time regression. However, since LAPP Tannehill works with such a wide breadth of products, some lead times might come in at 4 weeks whereas others are at 50+ weeks. This caused the average lead time standard deviation to peak at almost 60 days in January. Our current average lead time is about 40 days.”

In summary, the wire and cable supply chain situation is somewhat improved, with lower average lead times than even a few months back, the average lead times are still very high versus historical averages, and the standard deviation in lead times is still incredibly high indicating we have a long way to go before even approaching “normalcy” in the market.

(Note: Statistically speaking when the standard deviation of a data set is equal to or similar to the average it generally means that the underlying phenomena is greatly “out of control” with high variability).

What is the Supply Chain Model for the wire and cable industry and what are the issues?

The wire and cable industry’s supply chain model has many “links in the chain” and issues showing up at any one (or multiple) points can cause delays and ripple effects downstream of the chain.

The graphic below shows a representation of a typical supply chain for a multiconductor cable.

As you can see there can be 4 or 5 steps in the cable’s supply chain before it ever arrives at an Original Equipment Manufacturer at the end of the chain.

Since the beginning of the pandemic LAPP Tannehill, being a Distributor at the epicenter of the situation, has seen issues show up at any and every point (or multiple points simultaneously) in this supply chain model.

Some common examples we’ve witnessed in the past 2+ years include:

- Compound shortages (i.e. the polymer materials that cable manufacturers use as the basis for their wire insulation and cable jackets)

- Availability of finely-drawn copper wire conductors at the core of the cable (or even elevated shortages/pricing of underlying raw copper due to global imbalances in supply/demand and/or speculation in the commodity markets)

- Lack of sheer capacity within a manufacturer’s operations (at times dependent on one singular machine that is currently the pacing bottleneck on their production floor operations)

- A manufacturer’s sub-supplier experiencing any or all of the above issues

- Labor shortages (For example, a short-staffed warehouse at the contract manufacturer)

- Shortages of ancillary materials such as wooden spools

- Transportation / logistics issues. Everything from a shortage of drivers to bad weather impacting already-challenged shipping times.

And on and on. As one can see there are far too many unpredictable factors throughout this chain that could cause lead times to increase.

In “normal” times everything is balanced out at every level, but in the unprecedented times that we live and work in, where everything changes and becomes unpredictable, the wire and cable supply chain model (like every other supply chain in the world) has become exposed and vulnerable.

Can we look forward to supply chain improvements?

To quote the old proverb, “every cloud has a silver lining”, we do see bright spots starting to shed light on a more hopeful future for the industry.

As previously mentioned lead times have started to improve and while not at pre-pandemic levels yet, are expected to continue to improve as 2022 continues.

The most significant lead times recoveries appear to be coming from manufacturers that added capacity (staff, additional shifts, or more / more efficient machinery) early on in the supply chain crisis.

Companies that invested in capacity earlier are now experiencing more steady lead times. Adding capacity has now become fairly widespread throughout the wire and cable industry.

If companies have not already added capacity, they are currently in the process of doing so though the benefits from these later investments will take months to come to fruition.

Copper was really difficult to procure for many of our manufacturers early on in the pandemic. The supply has now stabilized for the most part though we continue expect price fluctuations due to macroeconomic and geopolitical forces copper.

For example, just in the last few weeks copper has plummeted in price to levels not seen since 2020 due to the China pandemic situation and general global recession concerns hitting most commodities.

Collaborative forecasting between suppliers and customers is much more common and efficient across the industry. In general, communications has improved greatly since the early days of the pandemic where every day seemed like “a giant game of telephone tag.”

How can we stay ahead of supply chain disruptions?

Vendor managed inventory based on forecast is becoming more popular to speed up supply replenishment. If you're not currently taking advantage this, then you should highly consider it.

Is inventory replenishment keeping you up at night? Ok, probably not, but making the process simpler during working hours will certainly help boost productivity and make your job easier.

You can reduce your inventory and replenishment costs, streamline and error-proof your processes, and quickly process and confirm orders through LAPP Tannehill's vendor managed inventory (VMI) services called the Quick Pick Program.

You don't have to put a lot of thought into re-ordering the products you frequently need. It can be as easy as scanning the low-inventory products you currently have which digitalizes into an order to be viewed, processed, and approved by our sales reps.

We may not be able to control lead times but you can get ahead of them by re-ordering your required stock as soon as possible.

Our Quick Pick Program VMI services provides our customers with their own scanner with advanced data capture technology to use on their warehouse floor - to scan in any items needing to be replenished.

Simply scan your products, view your order, cradle the scanner, and sync. Your products will be ordered and shipped right away - making repeat purchases easier than ever.

Learn more about our automated inventory replenishment solutions by reaching out via live chat or contact us for more info.