The Copper Boom: Understanding Record-High Prices & Inflation

- Kassie Teagarden

- Industry Trends

- Aug 1, 2024

- 14064views

The Copper Boom: Understanding Record-High Prices & Inflation

Written By: Kassie Teagarden, Lead Content Marketing Specialist, LAPP Tannehill

Copper prices hit a record-high in May 2024, driven by supply constraints and renewable energy demands, affecting manufacturing costs and global inflation.

LAPP Tannehill recently exhibited at the Electrical Wire Processing Technology Expo (EWPTE) in Milwaukee in May with sales representatives observing a lot of conversation with partners, competitors, and attendees around high copper prices. These conversations are happening beyond this event – they're happening at your place of employment, in the overarching industry, and in the global economy.

A lot has happened since our last article on copper prices in June of 2023 – 3 Positive Economic Trends in the Wire & Cable Industry - so, let’s talk about it.

Copper, often referred to as "Dr. Copper" for its diagnostic ability to gauge the health of the global economy, has experienced a dramatic rise in prices recently. This surge has had widespread ramifications across various sectors. Still, few have felt its impact as acutely as the wire and cable industry with some manufacturers marking up their prices by a staggering 45% due to increased raw material and labor costs.

When the cost of raw materials like copper rises, wire and cable manufacturers must adjust to maintain their profit margins. They can either absorb the increased costs (reducing their profit margins), seek alternative and less expensive materials (which might affect performance), or pass some of the increased costs on to distributors - and ultimately consumers.

Copper Prices Hit New Record High in May 2024

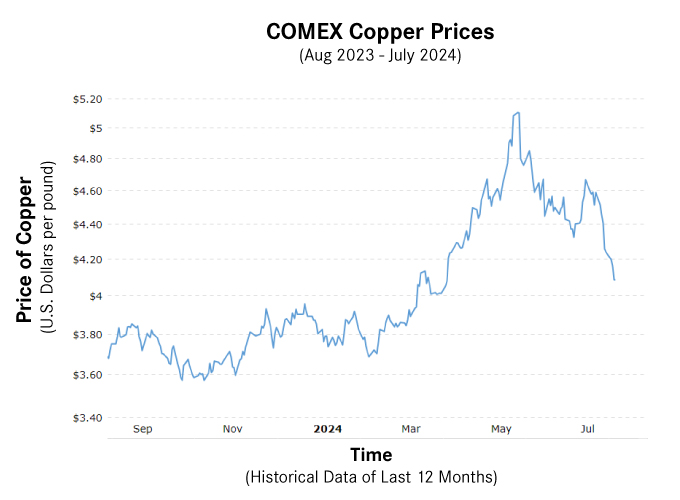

In May, the global economy witnessed the highest surge in copper price history. Copper prices surpassed their previous record of $4.94/lb in March of 2022 to a whopping $5.20/lb in May of 2024.

The following graph shows the last 12 months (August 2023 through July 2024) of copper prices spiking in May followed by a slow downward trend back to $4.12 on July 25th, 2024, which is approximately where prices were mid-April before the record high hit.

Graph shows the steady rise of copper prices from February 2024 to its record high in May 2024

See this interactive COMEX Copper Prices Chart for more historical trends.

The International Wire Group (IWG) updates the New York-based Omega-Camden Copper Index twice per month and includes transportation and other production costs in their rates. As of July 16, 2024, the base price for Omega-Camden Copper was $6.20 per pound.

Before predictions of higher prices came true, it was stated by Nick Snowdon, a Goldman Sachs Group Inc. strategist, that copper’s latest developments are only “the foothills of what will be its Everest.” He further forecasts prices will average an astonishing $6.81/lb by 2025.

Other Rising Commodities - Gold & Silver

In May 2024, gold prices reached a record high at $2,483.25 per ounce, bolstered by a 65% probability of a U.S. Federal Reserve interest rate cut in September. Silver prices hit $32.33 per ounce, which is the highest it’s been in 12 years, partly due to China's recent measures to stabilize its troubled property sector.

Investor sentiment is currently swayed by the anticipated monetary policy adjustments by the Federal Reserve, with precious metals acting as safe havens amidst economic uncertainty. These commodities not only serve as inflation hedges but also respond to shifts in currency strength and industrial demand, illustrating their complex roles in the global economy.

Why are copper prices rising when the U.S. dollar is strengthening?

The relationship between the strength of the U.S. dollar and the price of copper is typically inverse, meaning that when the dollar strengthens, copper prices tend to fall, and vice versa. So, why are copper prices still rising when the U.S. dollar is strengthening?

The dollar has appreciated significantly as of July 2024 due to several factors, including robust U.S. economic growth, higher interest rates compared to other major economies, and geopolitical tensions. The Federal Reserve's monetary policy tightening, aimed at combating inflation, has also played a crucial role in bolstering the dollar (J.P Morgan).

Copper prices are rising despite the strong U.S. dollar due to the electrification of multiple sectors, and the mining industry's inability to keep up with the increasing demand.

Electrification & Renewable Energy Push

Copper is a key component in the transition to renewable energy sources, such as wind turbines and solar panels, as well as in the production of electric vehicles (EVs). The growing demand for these technologies, driven by global efforts to combat climate change, puts upward pressure on copper prices.

The push towards renewable energy sources and electric vehicles (EVs) has significantly boosted copper demand. Copper is a critical component in renewable energy systems like wind turbines and solar panels, as well as in EVs, which require substantial amounts of copper for batteries, wiring, and charging infrastructure. Governments worldwide are investing heavily in green technologies to combat climate change, further driving demand.

>> Read more on How Copper Plays a Role in Future Sustainability

Mining Challenges & Supply Constraints

The supply side of copper has faced numerous challenges. Major copper-producing countries like Chile and Peru have struggled with these issues, leading to reduced output and increased prices. Mining disruptions due to the COVID-19 pandemic, labor strikes, and environmental regulations have constrained copper production over the last 4 years.

The Chilean copper mining industry faces critical challenges in maintaining sustainable production, particularly water and energy supplies. Key strategies to address these challenges include implementing Environmental Management Systems, seawater use, energy efficiency projects, and non-conventional renewable energy initiatives, which collectively help ensure continuous operation, cost reduction, and improved social license to operate (Leiva González & Onederra, 2022).

The Toromocho Copper Mine, one of the largest in the world, faced controversy after its initial community support waned due to unmet economic development promises and environmental issues, including a suspension for acid effluent discharge. The expansion project, part of China's Belt and Road Initiative, has exacerbated local social and economic hardships, causing ongoing disputes and protests against the mine's impacts (thepeoplesmap.net). These multifaceted challenges underscore the complexity of copper mining in Peru, requiring integrated and sustainable approaches to ensure environmental protection, social equity, and economic stability.

The $10 billion Cobre Panama copper mine in Central America, once a key economic project, is now idle due to nationwide protests over a new tax deal. The mine, essential to Panama's GDP, faced increasing scrutiny and government demands for higher royalties, leading to unrest and blockades by local groups. The closure signifies broader issues in the mining industry, where securing raw materials for green technologies often clashes with local environmental and economic concerns (mining.com).

Implications of Rising Copper Prices

Using Camden over COMEX

If you’re in a Purchasing role at an OEM and use COMEX as your pricing index for the latest forecast on copper prices – now is the time to use Camden with copper prices being so sensitive right now in the market.

Companies can use Camden over COMEX for more accurate copper prices because Camden provides localized pricing data that reflects immediate and specific regional market conditions. This regional focus can offer manufacturers better insights into their local supply chain and demand dynamics. Additionally, Camden’s pricing might capture short-term fluctuations more precisely, helping companies make more informed day-to-day operational decisions.

Manufacturers typically benefit from using COMEX to forecast copper prices due to its high liquidity and trading volume, ensuring accurate price discovery. COMEX is highly regulated, providing transparency and reducing the risk of price manipulation. It is a global benchmark for copper prices, widely recognized and used in the wire and cable industry. COMEX also provides extensive historical data, advanced analytical tools, and accessible trading platforms, facilitating real-time tracking and analysis.

So, while each index has its benefits, Camden is for more localized, immediate market conditions, and regional relevance while COMEX offers global benchmarking, standardization, and advanced financial instruments for risk management. The choice ultimately depends on the specific business needs, market scope, and operational strategies of the manufacturer.

We recommend examining both indexes for copper forecasting to gain a comprehensive understanding of factors influencing pricing fluctuations.

>> Read more on COMEX vs Omega-Camden Copper Prices

Global Inflation

Rising copper prices in 2024 could be an implication of inflation because commodities, like copper, make up more than a third of the Consumer Price Index (CPI), which is a primary measure of inflation.

Global inflation is often impacted by rising copper prices due to copper's integral role in the global economy. As a fundamental industrial metal, copper is essential in numerous industries, including construction, electronics, and manufacturing. When copper prices increase, the cost of producing goods that rely on copper also increases. This increased production cost can lead to higher prices for a wide range of products, contributing to overall inflation.

U.S. Bank admits investors often consider including commodities in their portfolios to hedge against inflation further supporting that rising copper prices is a strong implication of global inflation. “With inflation a little sticky, we think allocating a portion of a portfolio to inflation-sensitive assets makes sense for a diversified investor,” says Tom Hainlin, national investment strategist at U.S. Bank.

The impact of rising copper prices on inflation is particularly pronounced in developing economies, where manufacturing and construction activities are significant drivers of economic growth. Higher copper prices can lead to increased costs for infrastructure projects and consumer goods, straining household budgets and reducing disposable income. This scenario can exacerbate inflationary pressures as businesses pass on the higher costs to consumers, leading to an unfortunate cycle of rising prices.

This interconnectedness of copper prices and inflation underscores the metal's critical role in the global economy and its influence on economic stability.

U.S. Inflation

Copper prices and U.S. inflation have a significant correlation over the past decade, with a correlation coefficient of 70% or more, suggesting that copper prices and inflation tend to move in the same direction – subsequently aligning with high inflation and rising copper prices in the market today.

A significant factor affecting the U.S. economy is inflation inequality, which affects different demographic groups and economic sectors unevenly with wealthier individuals who are often better positioned to absorb price increases while lower-income groups suffer more significant financial strain.

As of the fourth quarter of 2023, baby boomers owned 51.8% of the country's total wealth, while millennials owned around 9.2%. This makes baby boomers 10 times wealthier than millennials and twice as wealthy as Generation X. However, the average millennial at age 35 has 30% less wealth than baby boomers did at the same age.

The wealth gap also has implications for aggregate demand. High levels of wealth concentration can suppress aggregate demand since the wealthy save a significant portion of their income, leading to lower overall consumption. Reduced consumption can slow economic growth and potentially reduce inflationary pressures in the short term. If the wealth gap continues to widen, it could lead to greater economic instability and more pronounced cyclical fluctuations in the long run. However, a generational wealth transfer is inevitable as boomers are passing down their life savings and assets to their children and grandchildren.

“The great wealth transfer, which we’ve all been talking about for the last 10 years, is underway,” said John Mathews, head of UBS’ Private Wealth Management division. “The average age of the world’s billionaires is almost 69 right now. So, this whole transition or wealth handover will start to accelerate” (CNBC).

The Greatest Wealth Transfer in history, which is the transfer of $84 trillion in wealth from Boomers to Millennials and Gen X, could have a significant impact on the economy. There is potential for a more balanced distribution of wealth which could bridge the economic gap and create more opportunities for financial growth and stability for all generations.

How to Alleviate the Impact of High Copper Prices

The surge in copper prices is a multifaceted phenomenon driven by robust demand, constrained supply, speculative investments, and geopolitical factors. As the world continues to navigate economic recovery, green energy transitions, and technological advancements, the copper market will remain a focal point for investors and policymakers. Understanding the dynamics behind copper prices can provide valuable insights into broader economic trends and future opportunities.

Brian Arickx, Director of Supply Chain at LAPP Tannehill states, "I want to assure our customers they can have complete confidence in us during copper price surges, global inflation, and economic uncertainty. Our strategic partnerships with key suppliers and robust inventory management allow us to maintain steady supply levels and mitigate price volatility. We are committed to staying ahead of trends to ensure our customers receive consistent and competitive pricing. In these unpredictable times, our commitment to reliability and transparency remains unwavering, guaranteeing you can depend on us for your wire and cable needs."

LAPP Tannehill announced the opening of the new Lapp Logistics Center in Brownsburg, Indiana in the fall of 2024 which will provide local and regional service to the major industrial clusters surrounding the state of Indiana as well as the broader eastern and southeastern United States. Read more on how this centrally located state-of-the-art facility provides faster shipping, improved order management, and a wider range of product availability to our customers.

Additionally, LAPP Tannehill offers their customers CMI and VMI as inventory management solutions to alleviate any additional distress during this time – read more in our article, How Modern Inventory Management with CMI and VMI Build Effective Supply Chains.