3 Positive Economic Trends in the Wire & Cable Industry

- Kassie Teagarden

- Industry Trends

- Jun 30, 2023

- 7627views

3 Positive Economic Trends in the Wire & Cable Industry

Written By: Kassie Teagarden, Senior Content Marketing Specialist, LAPP Tannehill

Check out the positive progress in these 3 economic trends in the wire and cable industry today - inflation, shipping costs, and copper prices.

U.S. Inflation is Slowing Down

According to the Bureau of Labor Statistics, consumer prices in May of 2023 experienced the slowest annual increase since March 2021, indicating that US inflation is moving away from its previously higher levels (CNN).

Although the rate of inflation is slowing down, Americans are still frustrated with the prices of goods and services being substantially higher than pre-pandemic levels.

The following chart is the inflation breakdown for May 2023 per CNBC showing significant changes from the highest inflation rate during the pandemic which was 9.1% in June of 2022.

Inflation Levels in May of 2023

How does global inflation affect the wire and cable industry?

The specific impact of inflation on the wire and cable industry can vary based on factors such as market conditions, competition, and the ability of companies to adapt to changing cost structures.

However, here are some ways that global inflation can affect the wire and cable industry today:

Cost of Raw Materials

Inflation can lead to an increase in the cost of raw materials, such as copper, aluminum, and plastics, which are essential for wire and cable production. If the prices of these materials rise due to inflationary pressures, it can raise the overall production costs for wire and cable manufacturers.

Production and Operating Costs

Inflation can also affect various production and operating costs for wire and cable companies. For example, labor costs, energy costs, transportation expenses, and maintenance costs may increase as inflation erodes the purchasing power of money. These increased costs can put pressure on profit margins within the industry.

Pricing and Profitability

Wire and cable manufacturers may face challenges in adjusting their product prices to reflect the increased costs resulting from inflation. If they are unable to pass on the higher costs to customers through increased prices, their profitability may be negatively impacted.

Investment and Expansion

Inflation can influence investment decisions and expansion plans within the wire and cable industry. When inflation is high or uncertain, businesses may become more cautious about making long-term investments, such as acquiring new equipment, expanding production capacity, or developing new products.

Consumer Demand

Inflation can affect consumer purchasing power and overall demand for goods and services, including wire and cable products. If inflation erodes consumers' disposable income or if they perceive products as becoming more expensive, it can lead to a decrease in demand for wire and cable products, which can impact industry sales and revenues.

For those in the construction industry, higher wire and cable prices could lead to increased project costs. For manufacturers and distributors, it may mean having to absorb some of the cost increases or passing them on to customers.

Shipping Costs are at Pre-Pandemic Rates

It was clear that the aftermath of COVID 19 caused a lot of disruptions in global supply chains that led to high shipping costs and the challenge of getting materials and finished products to their destinations.

The good news is that shipping costs are finally going back to pre-pandemic rates since March of 2023. The decrease in shipping and freight fees could have dual implications for the global economy.

Reduced shipping costs may yield advantages for certain sectors by lowering production expenses, potentially leading to decreased consumer prices. Conversely, other industries might encounter difficulties due to diminished demand and disruptions in the supply chain.

According to Freightos, an online freight marketplace, the current cost of shipping a 40-foot container from China to America's west coast is $1,400. This represents a significant decline of 93% from its peak of $20,600 in September 2021 and is approximately equal today to its price in February of 2020 (The Economist).

How do global shipping costs affect the wire and cable industry?

Overall, global shipping costs play a crucial role in shaping the economics and operations of the wire and cable industry. The industry's ability to manage and adapt to these costs is essential for maintaining competitiveness and ensuring efficient supply chain operations.

Here are some ways that global shipping costs affect the wire and cable industry:

Raw Material Prices

If shipping costs increase, it can lead to higher transportation expenses for importing these materials from their source locations. These increased costs can potentially raise the overall raw material prices, affecting the profitability of wire and cable manufacturers.

Manufacturing Costs

Wire and cable manufacturers often have global supply chains, sourcing raw materials and components from various countries. If shipping costs rise, it can increase the cost of transporting these materials to manufacturing facilities.

Global Competition

The wire and cable industry operates on a global scale, with manufacturers and distributors competing in both domestic and international markets. When shipping costs go up, it can affect the competitiveness of pricing.

Lead Times and Delivery

Higher shipping costs can result in longer lead times for receiving raw materials, components, and finished products. Delays in deliveries can disrupt production schedules and affect the ability to meet customer demands promptly. This can have a significant impact on customer satisfaction and relationships.

Copper Prices on a Downward Trend

In our previous copper prices blog posts in the past few years, there's been an upward trend in the price of copper whereas now there's been a steady decline.

Check out our last state of the industry article here - How the Inflation Reduction Act Impacts Wire & Cable.

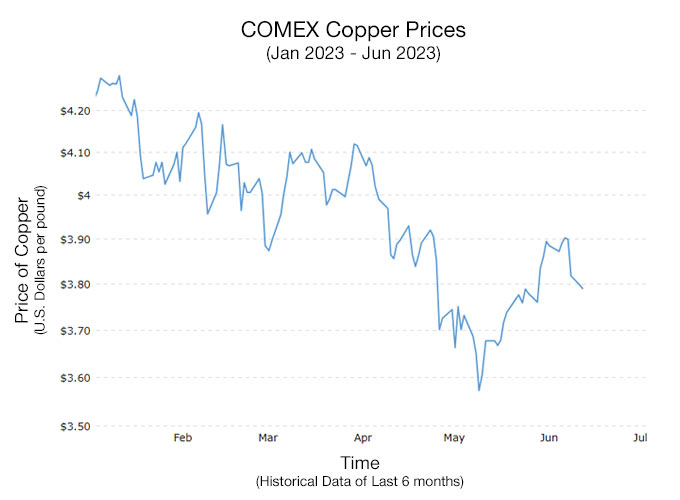

The following graph shows a trend in the last 6 months (January 2023 through June 2023) of copper prices falling at a gradual rate from January until May and then slowly rising again in June.

Graph indicating steady decline in copper pricing from Jan 2023 – May 2023 and a recent increase in June 2023

Check out the interactive COMEX Copper Prices Chart for more historical trends.

Copper prices have been known to be a pretty good indicator of economic health. So why has the price of copper gone down recently?

According to Chris Bataille, an adjunct research fellow at Columbia University's Center on Global Energy Policy, it appears that China has been vigorously constructing real estate for decades, and it seems that they have now accumulated a sufficient inventory of copper (Marketplace.org).

China has consumed approximately half of the world’s supply of copper over the past few years – and now that they have plenty in inventory, there is simply not as much demand and a bigger influx of supply.

This imbalance of supply and demand isn’t expected to last much longer though – the Indian government has substantial plans to invest in infrastructure and renewable energy. The post-pandemic demand for copper in India has risen over 27.5% in 2022.

With supply and demand changes for copper around the world, it’s expected that copper prices are on their way back up very soon.

In a recent projection, Goldman Sachs expressed an optimistic outlook for the copper market in 2023-24. The investment bank's analysts anticipate a significant price surge, with expectations for the current price of US$8500 per metric ton ($4.25/lb) to rise to US$11,000 per metric ton ($5.50/lb) this year, followed by further growth to US$12,000 per metric ton ($6.00/lb).

How does the price of copper affect the wire and cable industry?

Wire and cable manufacturers and distributors closely monitor copper price trends and adopt appropriate strategies to navigate challenges posed by copper price fluctuations.

Here are some ways copper prices affect the wire and cable industry:

Pricing Strategy

Copper price fluctuations can influence the pricing strategy of wire and cable manufacturers. When copper prices rise, manufacturers may need to adjust their product prices to compensate for the increased raw material costs. This can affect the competitiveness of their products in the market, as customers may seek alternatives or demand price concessions.

Inventory Management

Copper price volatility requires wire and cable manufacturers to carefully manage their inventory. Manufacturers and distributors may engage in hedging strategies or adjust their purchasing patterns to mitigate the impact of price fluctuations.

Market Demand

High copper prices can influence market demand for wire and cable products. In some cases, customers may delay or reduce their purchases due to higher prices. This can impact the overall demand for wire and cable products, affecting the industry's growth and revenue potential.

Global Competition

Manufacturers located in countries with lower copper prices or favorable trade agreements may have a cost advantage over their competitors. This can impact market share and the ability to export products to different regions.

Save Money with a Wire and Cable Evaluation

LAPP Tannehill, a trusted wire and cable distributor with a strong emphasis on supplying top-quality products, specializes in providing a wide range of wire, cable, tubing, connectors, and other related materials to their customers.

![]()

As a leading distributor, LAPP Tannehill prides itself on its excellent customer service, aiming to exceed client expectations with every interaction. One of the key factors that sets LAPP Tannehill apart from its competitors is their commitment to value-added services.

LAPP Tannehill understands that each customer may have unique requirements or specifications, and as such, they offer additional services to accommodate these needs. These services include wire striping, dyeing, twisting, and the provision of cut pieces.

If you are not sure which product to choose for your application, LAPP Tannehill sales professionals can suggest alternatives that can save your organization money.

Fill out our Wire Cable Evaluation form to get started!